internet tax freedom act wisconsin

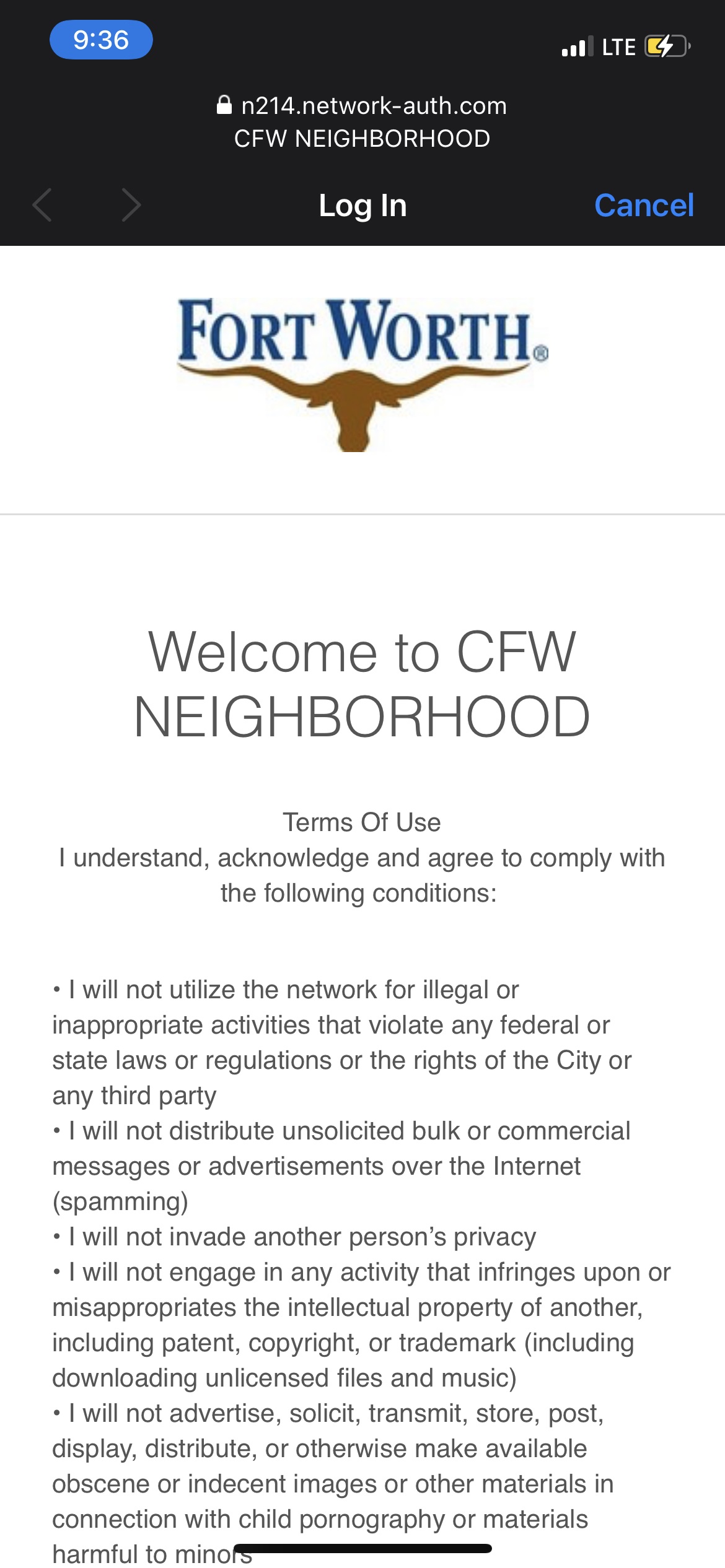

Effective July 1 2020 charges for internet access services are no longer subject to Wisconsin sales and use tax. This change correlates with legislation enacted in 2016 that.

Economic Freedom Wisconsin Institute For Law And Liberty

On June 30 2020 provisions pursuant to the Internet Tax Freedom Acts ITFA grandfathering provisions that permitted states and localities to tax certain internet access will expire.

. The Internet Tax Freedom Act of 1998 ITFA. 3086 the Permanent Internet Tax Freedom Act. The Internet Tax Freedom Act prohibits Wisconsin from imposing a sales tax on Internet access services but does not prohibit Wisconsin from taxing sales made via the internet.

Under the grandfather clause included in the. 113th Congress a bill that would. On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the Permanent.

Wisconsin is one of the states exempted from the Internet Tax Freedom Acts moratorium due to a pre-existing sales tax on Internet services. On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to. 235 the Act of Permanent Internet Tax Freedom.

The Permanent Internet Tax Freedom Act is a bill that would amend the Internet Tax Freedom Act to make permanent the ban on state and local taxation of Internet access and on multiple. Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute Share. Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet.

The 1998 Internet Tax Freedom Act is a United States law authored by Representative Christopher Cox and Senator Ron Wyden and signed into law as title XI of PubL. The Internet Tax Freedom Act originally enacted in October. The bill could be brought to the floor as early as July 14.

Wisconsin retailers must collect sales or use tax on sales made over the internet and shipped to Wisconsin addresses. 105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1. Meanwhile on July 15 2014 the United States House of Representatives voted to pass the Permanent Internet Tax Freedom Act HR.

The ten states are Hawaii New Hampshire New Mexico North Dakota Ohio South Dakota Tennessee Texas Washington Wisconsin. The House of Representatives passed HR. Internet tax freedom act wisconsin Thursday March 17 2022 Edit.

On June 17 the House Judiciary Committee approved HR. The Wisconsin Department of. While there was still anticipation that the Permanent.

On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the. Internet Tax Freedom Act ITFA The ITFA was enacted in 1998 as a 3-year moratorium preventing governments at the local state and federal levels from imposing. Internet Tax Freedom Act - Title I.

On December 15 2015.

Wisconsin Retainage In Construction Faqs Guide Forms Resources

![]()

Wisconsin Dem Cited For Tax Delinquency Lectures Billionaires To Pay Your Taxes

10 Ways To Boost Your Wi Fi Signal Pcmag

Wisconsin Court System Consolidated Court Automation Programs Ccap

Sales Tax Laws By State Ultimate Guide For Business Owners

Stop The Cap Internet Tax Freedom Act

Wis Dept Of Revenue Wi Revenue Twitter

State Labor Law Wisconsin Homebase

Proposed Legislation Would Prohibit Social Media Censorship Wisconsin Public Radio

The Permanent Internet Tax Freedom Act Bakerhostetler

Plan Details Information Edvest College Savings Plan

Business Answerline Small Business Development Center

Community Economic Development Division Of Extension

Internet Sales Tax Definition Types And Examples Article

Congress Makes Internet Access Tax Ban Permanent